On September 3, 2025, Finance Minister Nirmala Sitharaman announced GST 2.0, a major reform of India’s Goods and Services Tax system. It will be in effect from September 22, 2025. The new system simplifies to three tax slabs: 0% (exempt), 5%, and 18%, with a 40% rate for luxury and sin goods like high-end cars and aerated beverages. Essentials like UHT milk, paneer, and educational supplies are now GST-free. Packaged foods, medicines, and toiletries fall under the 5% slab.

These changes aim to boost demand in FMCG, healthcare, and infrastructure sectors. However, industries facing the 40% rate, like luxury vehicles, may face some challenges. Manufacturers must adjust pricing and supply chains to seize growth opportunities and manage compliance.

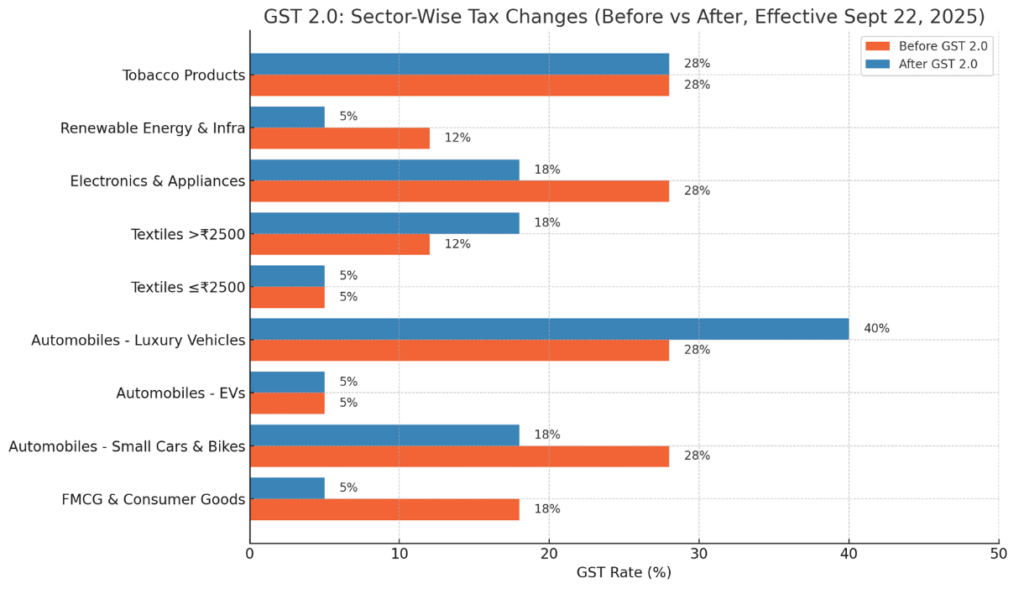

Sector-Wise Impact of GST 2.0

The GST 2.0 reforms, effective September 22, 2025, reshape consumption and manufacturing across key sectors. Note that tobacco products remain at 28% with cess until March 2026.

Consumer Goods & FMCG

- What Changed: Packaged foods, toiletries, and personal care items like hair oil and soaps are now at 5% GST. Staples like UHT milk, paneer, and Indian breads are exempt.

- Impact: Lower prices will likely boost demand, especially in urban and semi-urban markets.

Automobiles & EVs

- What Changed: Small cars (petrol ≤1200cc, diesel ≤1500cc, length <4m) and motorcycles (≤350cc) are now at 18%, down from 28%. EVs stay at 5%. Luxury vehicles face a 40% rate.

- Impact: Tax cuts may drive sales, pushing manufacturers to scale production.

Textiles & Apparel

- What Changed: Mass-market apparel (≤₹2,500) is at 5%. Garments above ₹2,500 are at 18%.

- Impact: Affordable clothing may see higher demand during festive seasons.

Electronics & Appliances

- What Changed: TVs, air conditioners, and refrigerators are now at 18%, down from 28%.

- Impact: Lower taxes and simpler pricing should boost mid-range electronics sales.

Renewable Energy & Infrastructure

- What Changed: Solar panels, cells, and farm equipment like tractors are now at 5%.

- Impact: Reduced costs support clean energy projects and rural infrastructure growth.

GST 2.0 promotes mass-market consumption and infrastructure growth. Manufacturers should recalibrate pricing, production, and supply chains to leverage demand.

Trends to Watch in the GST 2.0 Era

Industry analysts widely expect GST 2.0 to unlock a wave of demand across FMCG, automotive, textiles, electronics, and renewable energy. While external pressures like US tariff hikes may weigh on exports, GST 2.0 is expected to offset some of the drag by strengthening domestic consumption.

For manufacturers, the central question is how to meet this surge in demand without eroding margins. Companies broadly face two strategic paths:

- Expand Capacity: Some may respond by building new production lines, expanding warehouses, and hiring more manpower. While this approach can raise output, it also locks manufacturers into heavy capital expenditure, longer payback periods, and higher exposure if demand stabilizes or dips after the initial spike.

- Streamline Operations: Instead of chasing scale through costly expansion, forward-looking manufacturers are turning to ERP-driven efficiency. By optimizing procurement, aligning production with real demand, and preventing excess stockpiling, ERP systems free up working capital and make growth more sustainable. For example, SourcePro client data showed that a mid-sized manufacturer (₹50–100 Cr turnover) reduced inventory significantly after ERP adoption, leading to ₹45 lakh in annual interest savings– a clear proof that scaling demand can be achieved without scaling costs.

As GST 2.0 reshapes India’s consumption landscape, manufacturers that streamline intelligently will be better positioned to capture growth while staying lean, liquid, and resilient.

Rising Demand, Ready Systems: ERP in the GST 2.0 Era

With GST 2.0 expected to push demand across FMCG, automotive, textiles, and infrastructure, ERP is no longer just an efficiency tool- it becomes the backbone of operational readiness. Beyond helping manufacturers scale or streamline, ERP delivers control at every stage of the value chain.

Key Areas Where ERP Makes the Difference

- Scaling Production with Precision

ERP connects demand forecasts with production schedules, ensuring that rising orders don’t translate into costly stockouts or overproduction. Automated material requirement planning (MRP) helps balance raw material procurement with output, avoiding unnecessary working capital lock-ins. - Synchronizing the Supply Chain

Tax reforms under GST 2.0 demand tighter coordination between suppliers, warehouses, and distributors. ERP unifies these functions on a single platform, updating tax rates and exemptions instantly to ensure correct invoicing and smooth deliveries—all while offering real-time visibility to spot bottlenecks early. - Staying Audit-Ready

With risk-based scrutiny and tighter oversight in play, ERP minimizes compliance risk by validating HSN codes, generating GST-compliant invoices, and enabling pre-filled returns. This reduces the scope for human error and strengthens audit trails when authorities demand checks. - Strengthening Cash Flow

Liquidity is a major differentiator in growth phases. ERP tracks provisional refunds, manages payments, and aligns receivables with updated GST rules (such as restricted ITC on select 5% services). Manufacturers gain the confidence to expand knowing that cash flow won’t choke their growth momentum.

Seize GST 2.0 Opportunities with SourcePro ERP

GST 2.0 is transforming India’s manufacturing landscape, driving rising demand across FMCG, automotive, textiles, electronics, and renewable energy. Manufacturers who adapt pricing, production, and supply chains quickly can turn these changes into growth.

SourcePro Manufacturing ERP helps businesses stay ahead – automating pricing, optimizing inventory, coordinating supply chains, and ensuring GST compliance. With real-time visibility and smart operational control, manufacturers can capitalize on new demand, minimize risks, and convert GST 2.0 challenges into opportunities.